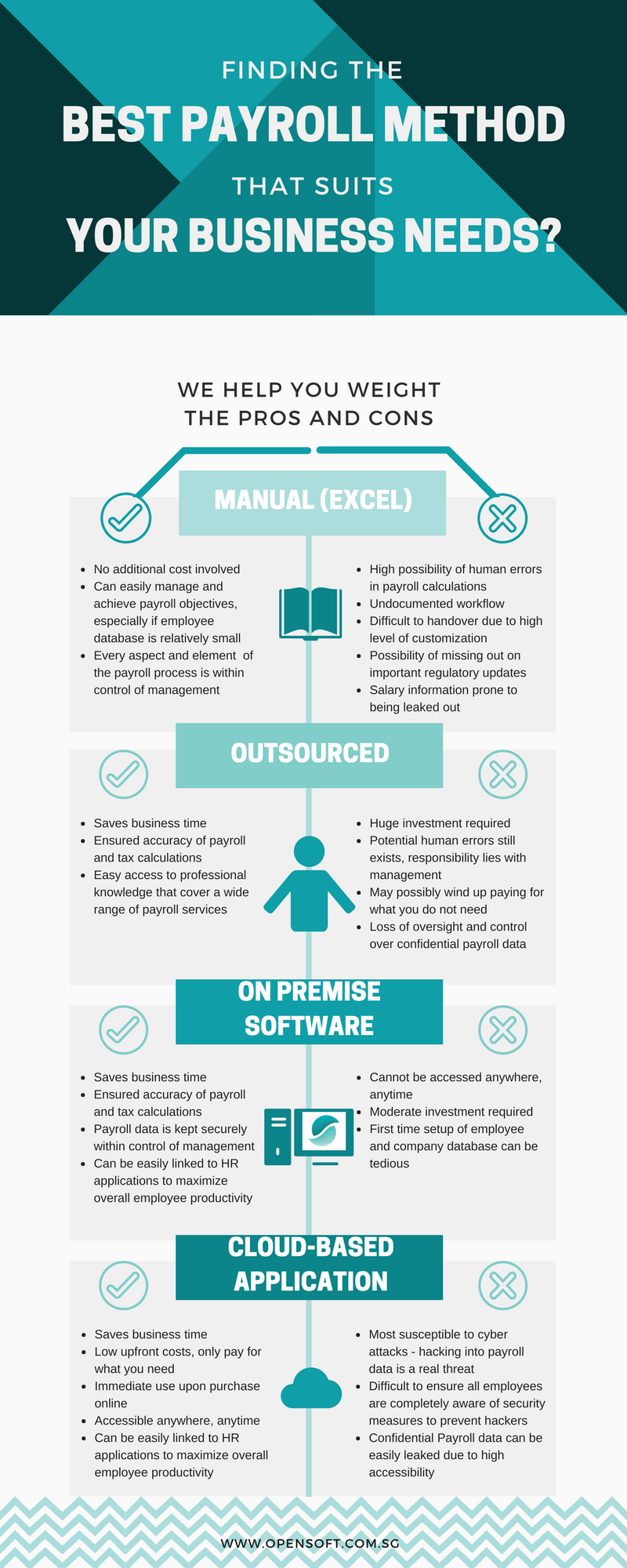

This infograpic helps you to weigh the pros and cons of typical payroll processing methods used by businesses in the world.

The purpose of this infographic is to provide you clarity as to which is the most ideal payroll method that suits your business requirements. To start, we need to know the differences, advantages and disadvantages between the most commonly-used methods of managing payroll.

Common Payroll Methods Compared

1. Excel Payroll

2. Outsourced Payroll Service

3. On-premise Payroll Software

4. Cloud Payroll Application

Excel Payroll

Pros:

• No extra cost involved as most companies do have Excel as their basic software

• Simplest way to manage payroll when employee database is relatively small

• Every aspect and element of the payroll process is within control of management

Cons:

• Prone to human errors in payroll calculations

• Undocumented workflow, thus lack audit trails

• Difficult to handover due to high level of customisation

• Possibility of missing out on important regulatory updates

• Salary information prone to being leaked out

Outsourced Payroll Service

Pros:

• Saves business time

• Ensured accuracy of payroll and tax calculations

• Easy access to professional knowledge that cover a wide range of payroll services

Cons:

• Huge investment required

• Potential human errors still exists, responsibility lies with management

• May possibly wind up paying for what you do not need

• Loss of oversight and control over confidential payroll data

On-premise Payroll Software

Pros:

• Saves business time

• Ensured accuracy of payroll and tax calculations

• Payroll data is kept securely within control of management

• Can be easily linked to HR applications to maximize overall employee productivity

Cons:

• Cannot be accessed anywhere, anytime

• Moderate investment required

• First time setup of employee and company database can be tedious

Cloud Payroll Application

Pros:

• Saves business time

• Low upfront costs, only pay for what you need

• Immediate use upon purchase online

• Accessible anywhere, anytime

• Can be easily linked to HR applications to maximize overall employee productivity

Cons:

• Most susceptible to cyber attacks – hacking into payroll data is a real threat

• Difficult to ensure all employees are completely aware of security measures to prevent hackers

• Confidential Payroll data can be easily leaked due to high accessibility

Home

Home