Updated on: 7 January 2021

Beyond salary processing, the functions of basic payroll involves managing, keeping and securing accurate employee records. With flexible work schedule and staff on remote working, companies require a strategy for managing employee attendance, performance, rewards, and compliance with manpower regulations. A good payroll software and HRMS system helps to automate many of these tasks, improve compliance and promote the productivity of workforce.

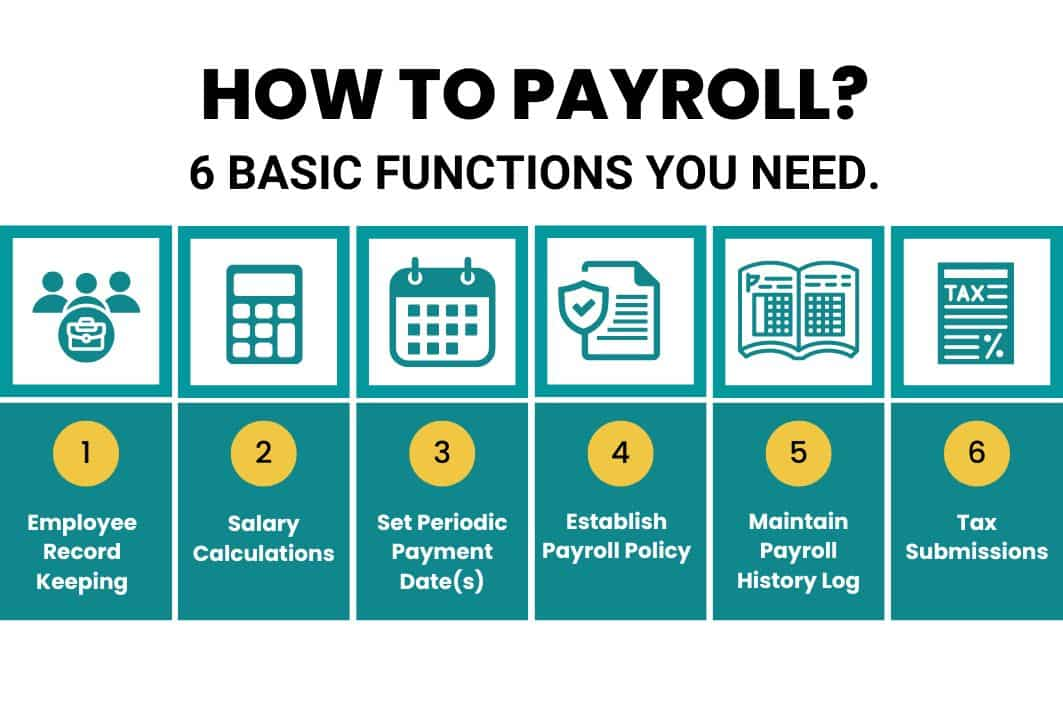

Basics of Payroll

Have you recently started out a business and hiring employees for the first time? Scratching your head and wondering: “What is Payroll?”

Let’s start off by defining just that. Payroll refers to all the financial records and data pertaining salaries, wages, overtime, bonuses, deductions related to entities, employees, owners or partners paid for services provided during a specific period of time. Such information is generally required for the filing of taxes and submission of regulatory forms. It may seem simple and easy, but Payroll itself contains a lot of sensitive information that needs to be handled systematically and accurately. Every business needs a Payroll system in place, even if there’s only one or two employees.

We talk a lot about the importance of a Payroll Software and how it contributes to efficiency within Human Resource(HR) operations. However for those of you who are just starting out and haven’t had much exposure to how Payroll is done, the actual task of processing your business’ payroll can get increasingly complex and difficult to manage. As a Payroll Software provider we’ve seen what it takes for businesses to achieve an efficient Payroll system, so whether or not you intend to process your business’ Payroll through a Payroll Software, Excel or even on Paper, here are some key steps that you can take to build the best Payroll system for your business.

Step 1. Employee Record Keeping

Having a detailed record of each employee is the first thing you want to start with. Aside from keeping compliant to MOM requirements, building a solid employee database is essential for any Payroll system to function. A proper management of employee records can also contribute to you being able to effectively monitor the performance and productivity of your employees.

Key components in Employee Records that you’ll want to include:

- Basic Information – Refers to personal information such as employee’s full name, identification number, nationality, address, birth date, contact number, employment date etc. This section can also include emergency contacts.

- Salary Details – This includes various components of an employees’ salary, namely basic pay, bonuses, commission and contributions.

- Statutory Information – Income Tax Reference number, Banking Info and Immigration Info where applicable. Information here is generally also required for tax reporting purposes.

- Confidential Agreements/Documents – Employee contracts, resumes, resignation agreements etc. should be kept in your employee records for easy access and referring for checks.

Step 2. Salary Calculations

Now that you’ve got your employee database ready, the next step is putting together the components of employees’ salary. Some key considerations to factor in:

- Are employees’ salary calculated by hours or days?

- How is no pay leave calculated?

- If your employees are entitled to bonus, how is it measured?

- How should overtime be calculated?

- If employees are late or early for work, how do you calculate allowances and deductions?

It’s always a good idea to classify your employees, whether they are full-time, part-time or contract, with there being different tax requirements and minimum wage regulations you’ll want to adhere to. Additional components that must be factored into employees’ salary:

- CPF Contributions – Businesses operating in Singapore are expected to comply with CPF(Central Provident Fund Board) contributory requirements. To calculate contributions for employees’ CPF, you may click here.

- Foreign Worker Levy (FWL) – If your business employs foreign workers, there is a monthly levy requirement for Work Permit and S Pass holders via General Interbank Recurring Order (GIRO).

- Contribution to Self Help Group Funds – They include SHARE, CDAC, ECF, MBMF and SINDA. If your employees contribute to aforementioned self help group funds, these contributions and donations are to be deducted from employee’s wages together with the employee’s share of CPF contribution as well.

Step 3. Set Periodic Payment Date

Employees cannot go too long without a salary, and you can’t possibly be processing Payroll say, every day. It’ll be a complete nightmare! Take note however, that employees’ salary must be paid within 7 days after the end of the salary period – and non-payment of salary will be considered an offence.

Step 4. Establish Payroll Policy

For your employees to know when to and what to expect on payday, you must establish relevant payroll policies that are clearly communicated to, and understood by all of your employees.This will include:

- Salary calculations, Pay Periods and Payday – You’ve already established a process for reimbursement of employees’ salaries. The next step is to ensure your employees are aware of pay periods and paydays that are relevant to them. Should they be paid on a monthly basis, they will need to know the start and end dates for the month long pay period, and the actual payday.

- Time & Attendance Guidelines – Clearly state what your employees need to do in order to achieve a proper time sheet submission. For those of you who record employees’ time & attendance manually and require employees to fill out a time sheet, you may want to convey rounding procedures, time sheet submission deadlines, who is assigned to endorse them and most importantly, highlight the consequences of falsifying time sheets.

- Employee Benefits – Break down the benefits offered to employees and how they can be obtained. Employee benefits may include annual leave entitlements for vacation, sick, personal and bereavement, health and life insurance, business expense reimbursements and paycheck advances.

Now that you’ve got it all set up, it’s time to pay your employees. Which brings me to the next point for consideration- Payroll logistics. Depending on your company’s preference, payroll can be delivered via cash, cheque or GIRO. As of 1 April 2016, it is mandatory for all businesses in Singapore to issue itemized payslips to employees covered under the employment act.

Step 5. Keep Track of Payroll History

If there is no proper documentation of payroll history, it can be quite difficult to answer to management when an issue pertaining to past payroll data crops up at some point in the future. Common situations where businesses require to dig up past payroll records include difficulties in balancing accounting books within the finance department, and discrepancies in salary payments.

In addition, it is a legal obligation that businesses in Singapore are required to keep payslip records of at least 2 years of their existing employees, and 1 year of resigned employees.

Step 6. Ensure Tax Submissions

Avoid unnecessary penalties of your business’ taxes by constantly keeping yourself updated with the latest regulations and submission dates. In Singapore, all businesses are expected to prepare Form IR8A and Appendix 8A, Appendix 8B or Form IR8S (where applicable) for employees by 1st March every year.

That aside, you will have to comply with the method of filing taxes as well. From Year of Assessment 2017, it is a requirement for all businesses who have either received a notice from IRAS(Inland Revenue Authority of Singapore) or have 10 or more employees during the entire year, to submit income information electronically via the Auto-Inclusion Scheme (AIS).

Of course, a Payroll Software or Service Provider can come in very handy when you’re caught up with other business matters, and lack of manpower to manually check the Payroll process from end-to-end. However outsourcing Payroll services and running Payroll through a software does require a considerable investment, so you have to think about your own business needs and decide what works the best for your business. Ultimately, it is recommended to keep it as simple as possible and always make sure your process is constantly reviewed and updated to be in compliance with employment regulations at all times.

Home

Home